Hong Kong Business News

香港商業資訊

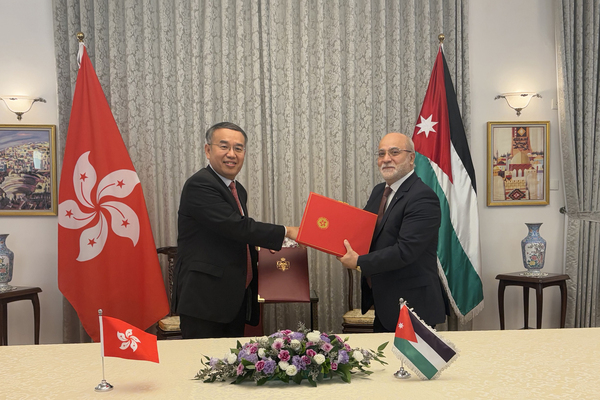

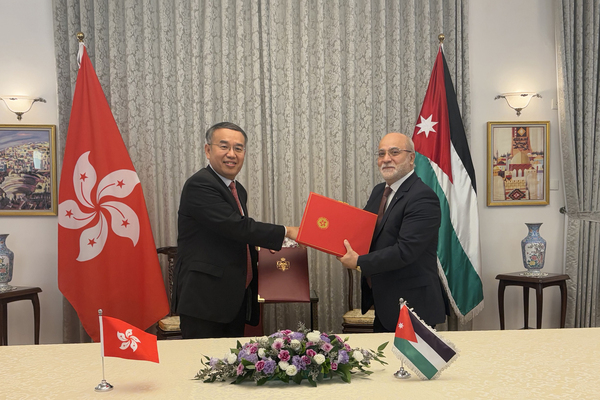

HK, JORDAN SIGN TAX PACT

4-9-2025

Secretary for Financial Services & the Treasury Christopher Hui had a bilateral meeting with Ambassador of Jordan to China Hussam Al Husseini in Beijing today, and signed on behalf of the Hong Kong Special Administrative Region Government a comprehensive avoidance of double taxation agreement (CDTA) with the Jordanian government.

In accordance with the CDTA, Hong Kong residents can avoid double taxation in that any tax paid in Jordan will be allowed as a credit against the tax payable in Hong Kong in respect of the same income, subject to the provisions of the Inland Revenue Ordinance. Moreover, Jordan’s withholding tax rates for Hong Kong residents on dividends, interest and royalties, currently at up to 10%, will be capped at 5%.

At the bilateral meeting, Mr Hui presented to the Jordanian official the advantages and latest developments of Hong Kong’s financial market, including the efforts made to promote the growth of the financial market and establish the city as an international gold trading centre.

Mr Hui said, “The CDTA signifies the determination of the Hong Kong SAR Government in expanding Hong Kong’s CDTA network and its enhanced collaboration with tax jurisdictions participating in the Belt & Road Initiative.”

He also highlighted that the CDTA sets out the allocation of taxing rights between Hong Kong and Jordan, which will help investors better assess their potential tax liabilities from cross-border economic activities.

“I have every confidence that it will be an excellent starting point to enhance the financial, economic and trade connections between the two places.”

Additionally, Mr Hui stated that the Hong Kong SAR Government will continue to expand Hong Kong’s CDTA network to enhance the city’s attractiveness as a business and investment hub, and consolidate its status as an international economic and trade centre.

The Hong Kong-Jordan CDTA is the 53rd such pact that Hong Kong has concluded. It will come into force after completion of ratification procedures by both sides.

In Hong Kong, the Chief Executive in Council will, under the Inland Revenue Ordinance, make an order which will be tabled at the Legislative Council for negative vetting.

PREVIOUSNEXT

Latest Business News

最新商業資訊

HK, Jordan sign tax pact 4-9-2025

Secretary for Financial Services & the Treasury Christopher Hui had a bilateral meeting with Ambassador of Jordan to ...

Balloon fest gets safety consideration 4-9-2025

The Government today said that the AIA International Hot Air Balloon Fest Hong Kong is a commercial event, and the organi...

Public alerted to fake Treasury emails 2-9-2025

The Treasury today issued an alert regarding fraudulent emails purportedly sent by it, which seek to obtain recipients’...

Sci-tech cluster ranks top globally 1-9-2025

The Hong Kong Special Administrative Region Government today welcomed the World Intellectual Property Organization’s na...